Family security calculators Estimate your own borrowing from the bank strength today

Whenever evaluating capability to service a loan, Westpac may use mortgage loan that is greater than the brand new current interest rate to your loan questioned. Your lender may charge a software fee to help you processes and put your home loan. The financial institution also can charge charge for those who demand additional fund otherwise make modifications on the financing. Regarding to shop for property, there is more cash inside than just the first deposit.

Security within the established house

If you don’t, they could fail to recover the complete amount that have interest. Merely which have nice places and you may multiple possessions does not mean a keen personal provides sufficient cash flow to settle that loan. A person’s borrowing strength actions you to’s power to generate lingering loan costs. Borrowing from the bank power is amongst the 5Cs out of borrowing from the bank analysis with each other which have profile, investment, collateral, and conditions.

- Your own expenditures will likely be impacted by things like the number of dependents on the family members, people latest house otherwise consumer loan payments or any other monetary requirements including personal medical insurance.

- Because the interest levels increase, and you have a variable rates mortgage, your repayments often rise too.

- The pace found boasts any applicable interest dismiss from the new list speed.

- Lenders don’t shell out to feature within our dining tables, nor do we secure commission for individuals who click to go to a great lender’s website.

- Although not, the maximum LVR alter away from financial so you can lender.Which have a guarantor means that the mortgage is secure from the a couple services, reducing the lender’s risk.

Initiate the application on the web

A guarantor is actually an individual who agrees to take obligation to suit your loan if you are struggling to result in the payments.

Which extra shelter decreases the lender’s exposure, that can lead to a higher borrowing from the bank capability of your. It can also help you secure financing with an increase of advantageous words, such as a lower interest. Although not, you will need to keep in mind that the new guarantor need to have an effective economic reputation and become ready to undertake it obligations.

Sure, HECS financial obligation can aid in reducing your credit energy since the money reduce your throwaway earnings and increase your debt-to-income ratio, which loan providers use to determine how far you can acquire. Yes, implementing which have a partner can increase their credit power since your shared earnings is actually highest plus total budget are stronger. But not, lenders may also determine both of your financial situation and you may credit histories, that may change the outcome. If sometimes companion has significant expenses otherwise a dismal credit rating, this may reduce the number you might use.

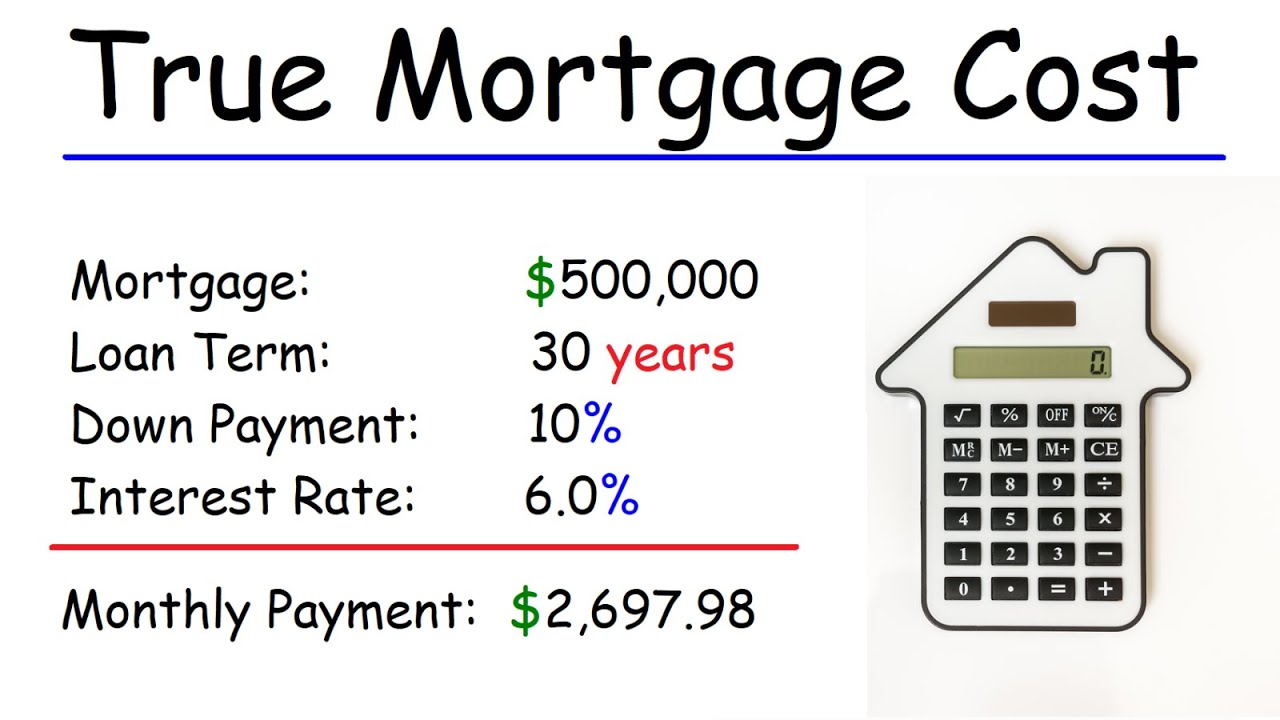

Considering CBA, an excellent rule of thumb is the fact your mortgage payments shouldn’t exceed 29% of one’s net income, guaranteeing you may have sufficient freedom to many other expenditures and you may savings. Discounted dos 12 months fixed price whenever credit 80% otherwise a reduced amount of the house valuedisclaimeron holder occupied home loan which have principal and interest payments. Very mortgage brokers are supplied more than 30 years (360 months), and this enhances borrowing strength. When you’re extended conditions can be found, it trigger paying far more complete focus along side existence of the loan.

Mortgage evaluation rates is determined according to financing amount from $150,000 paid more than an excellent twenty five-12 months identity that have monthly money. Some other mortgage numbers and you can terms can lead to some other assessment costs. Will cost you such as redraw costs otherwise early payment costs and value discounts for example commission waivers commonly as part of the evaluation speed but can determine the cost of the borrowed funds. Consult the new supplier to possess complete loan details, in addition to cost, costs, qualifications and you can conditions and terms to be sure the merchandise try best for you. Generally, your own borrowing from the bank power try computed as your net gain without the expenses. The costs will be impacted by things such as how many dependents in your family members, one most recent home or consumer loan money and other financial requirements such personal health insurance.

The higher the quantity, the much more likely you are to invest straight back the cash to your some time and the brand new much safer you’re to loan providers. And that’s in addition you usually need to use out loan providers mortgage insurance (LMI) with in initial deposit from below 20% of one’s cost – and this merely increases your own expenditures. Right here, we falter what borrowing energy try, how it’s determined and, if this’s perhaps not where you want it to be, how you can try and increase they.

Decide how much you can afford so you can obtain based on the property’s money possible. Concurrently, these are certain steps one can possibly attempt enhance their credit strength. Let’s look at the different ways to raise credit skill. Very, he taken out one to at the about three creditors — DMS Financial, ABC Economic Functions, and you may PQR Financial, to determine what financial provided by far the most favorable mortgage terminology. You reside more than simply a location to reside—it’s an important financing to own finding your financial wants. If or not you’re also considered home improvements, combining financial obligation, otherwise money a big milestone, our house equity hand calculators try right here to assist.