Ho-Ho-Ho Position: Free Spins & Join Incentive

Content

It differs from a basic HO-step 3 policy, and that happy-gambler.com good site merely covers the structure of your house on the an unbarred risks base along with your individual possessions to possess titled risks. Total, if you’re looking to the large quantity of defense for the family and private belongings, an enthusiastic HO-5 rules may be the best one for you. One of the trick great things about a keen HO-5 plan would be the fact they talks about your own personal belongings because of their complete replacement for prices, rather than the cash value.

The best Ho-5 Homeowners insurance Publication

Before element starts, a random regular symbol is selected to behave as the an expanding icon from the entire totally free revolves sequence. Moon of Thoth Betting ought to be enjoyable, not a source of fret otherwise damage.

Will you be to the Santa’s Listing?

Under HO-step three insurance coverage, your residence often typically be protected during the its replacement costs, when you are your personal property might possibly be protected as much as the genuine cash really worth. You will find eight different types of “standard” homeowners insurance principles that you could find because you go shopping for insurance coverage. Less than, we walk through area of the form of home insurance rules your can come across and you will explain the secret differences when considering her or him. Of coverage possibilities to help you costs guidance, Progressive Responses is the strong dive to your home insurance.

Individual possessions, but not, is covered for the a called-hazards foundation. Usually, homeowners insurance will bring economic defense against catastrophes, robberies, and you may accidents. An excellent 2020 Forbes Advisor questionnaire learned that 72% out of property owners don’t understand home insurance publicity.

HO-5 rules provide open-peril exposure for your house and its own content material. HO-5 formula render premium exposure to own proprietor-filled property. Although not, HO-step 3 principles render open-danger coverage for your house’s construction.

Q: Just how can HO-step 3 and HO-5 regulations disagree with regards to visibility?

Sewer and you will h2o content publicity is an additional well-known option, which covers your residence up against destroy through sewage content otherwise a deep failing sump pump. Having a keen HO-step three policy, you need to confirm that your particular individual assets claim happened on account of one of several titled hazards noted on the policy. HO-5 insurance rates also provides replacement for prices exposure to suit your personal assets. Simultaneously, HO-5 principles could possibly get security extra cost of living including hotel and meal will set you back if the home is busted and you may uninhabitable due to a good protected claim. HO-5 insurance rates also provides liability insurance coverage, which takes care of unintentional real injury or possessions problems for anybody else one to you’re accountable for.

The brand new HO-5 plan, as well, covers all the dangers except those that are especially excluded from the plan. The new HO-5 plan provides larger exposure and higher restrictions for personal property and you will liability. It rules covers ruin due to natural disasters, theft, flames, or other dangers, subject to specific exceptions and you may limitations. Unlike simple HO-step three rules, which give publicity to possess specific entitled risks, an enthusiastic HO-5 rules provides visibility for everybody dangers unless he or she is particularly omitted regarding the policy. However, HO-5 formula are unique benefits that most HO-step 3 formula just offer because the elective coverages, such as individual property substitute for cost publicity.

With an upgraded costs package, the fresh citizen is actually refunded the total amount it will set you back to replace the damaged Television from the today’s car or truck. It can also be more pricey, as the exposure is typically more inflatable than just an enthusiastic HO-step 3 rules. They give broad exposure for the household, as well as its design, information and you can responsibility shelter. Eventually, contrasting quotes out of multiple enterprises before you choose one can make it easier to choose the best fit for your circumstances – and possibly make it easier to house a less expensive rules. The state where you alive, the size and style and condition of your property, their states records as well as the visibility and limitations you purchase tend to the alter exactly how much you have to pay. Because you you’ll assume, a keen HO-step one rules could be cheaper than a fundamental HO-3 coverage as it also offers quicker publicity.

HO-5 principles give replacement for rates publicity for personal assets. In addition, it discusses individual belongings, guaranteeing them against the dangers until specifically titled by plan. There are some a method to decrease your HO-5 rules superior without having to sacrifice publicity. Homeowners insurance rules can differ in expense depending on the type out of exposure you want and also the level of risk your expose for the insurance carrier. This can be distinct from entitled peril visibility, and that simply talks about threats that will be clearly listed in the insurance policy.

When looking for the new visibility to suit your possessions, you’ll rapidly discover that there are various sort of property owners insurance rates offered. HO-step one insurance policies will not offer visibility for most hazards which may trigger pricey problems for your residence and you will does not have liability and personal property coverage. Most other homeowners insurance rules variations is exposure for additional lifestyle costs. Instead of most other homeowners insurance rules, HO-step 1 insurance policies doesn’t offer accountability security, nor does it security your own home or render compensation to possess additional living expenses. HO-5 insurance policies will bring coverage both for your property and personal home below an unbarred dangers coverage.

- Publicity is at the mercy of the new fine print of your own applicable plan, availableness, and you can official certification for coverage and may also vary because of the condition.

- HO-8 principles are usually used in lieu from HO-3 regulations to possess elderly house you to aren’t qualified to receive a basic plan.

- HO-4 insurance is available for renters simply, which have publicity for death of fool around with (should your tenant struggles to are now living in its hired household otherwise apartment), private assets, and you may liability.

- People who are a novice for the community out of web slot games provides lots of worries and you will misgivings, for example how much they should wager what is the littlest tolerance out of bet.

HO-dos principles is actually one step upwards away from HO-1 principles, but do not render as much publicity as the a keen HO-step 3, which is the common type of homeowners insurance plan. A total sort of home insurance, HO-5 regulations offer owners that have unlock peril (otherwise all the-risk) publicity to your one another the house as well as their private possessions. The fundamental home insurance policy is a keen HO-5, getting unlock hazards publicity with protected substitute for rates for primary and you may secondary house. An HO-1 insurance coverage merely covers particularly titled problems, and you can publicity is usually limited to your residence’s framework or other formations on your property, such as an excellent gazebo or isolated driveway. HO-5 homeowners insurance is a type of insurance plan that provides wider protection and better coverage constraints than simply normal property owners formula.

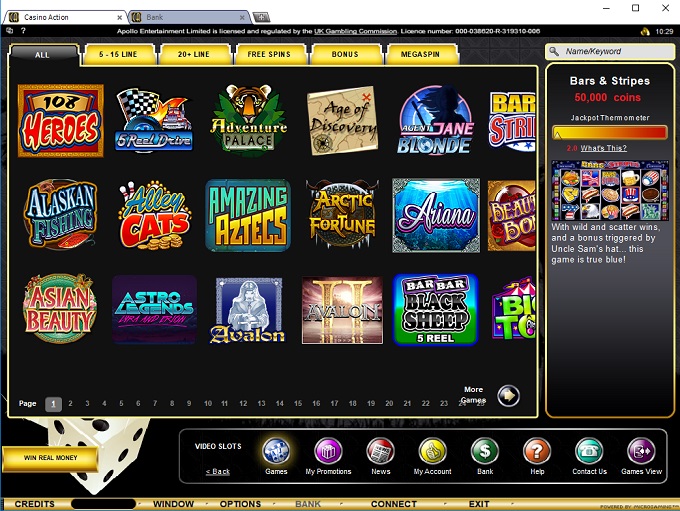

Like most Microgaming slots, you could purchase the number of contours within the play, the amount of gold coins wager for each line plus the proportions of those coins. Almost every other signs tend to be a totally adorned Christmas forest, a sleigh that is chock-a-cut off that have gift ideas and in the lead is Rudolph. That have 5 reels and you may 15 paylines all the decked within the Christmas design and you can Yuletide grub, this game is essential wager anybody who simply cannot watch for December twenty five ahead up to. Or more claims the fresh Santa claus reputation just who takes the newest reins of the festively styled video slot by the Microgaming.

While you are each other element a swirl from pie and you will ointment, refined but really tall differences in the structure, texture, and style reputation put her or him aside. Some traditional exceptions is wreck on account of earthquakes, floods, landslides, and you may mould. When you’re HO-5 coverage usually has more information on exclusions, these could will vary by company. Identity theft and fraud coverage is even readily available and may also assist reimburse you to possess aside-of-pouch expenses related to identity theft and fraud, for instance the cost of repairing your own borrowing from the bank and you can attorneys fees.

The level of dwelling visibility necessary to the a HO-six plan depends upon just how much of your framework are included in your own condominium/home owners connection. Such HO-3s, the fresh HO-5 plan talks about injury to your home’s construction away from risks you to definitely aren’t authored into the coverage while the excluded. The fresh HO-5 plan also provides a lot more security than just about any other type out of homeowners insurance.